gilti high tax exception example

Tax liability would be increased and 3 each US. Gilti High Tax Exception Example.

Getting To Know Gilti A Guide For American Expat Entrepreneurs

Back in July the Treasury Department and IRS issued final regulations.

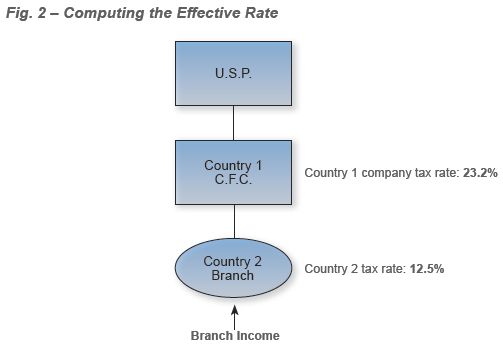

. Fundamentally its a tax on earnings that exceed a 10 return on a companys invested foreign. GILTI Net CFC Tested Income 10 percent x QBAI Interest Expense Example. This threshold is unchanged from the proposed regulations.

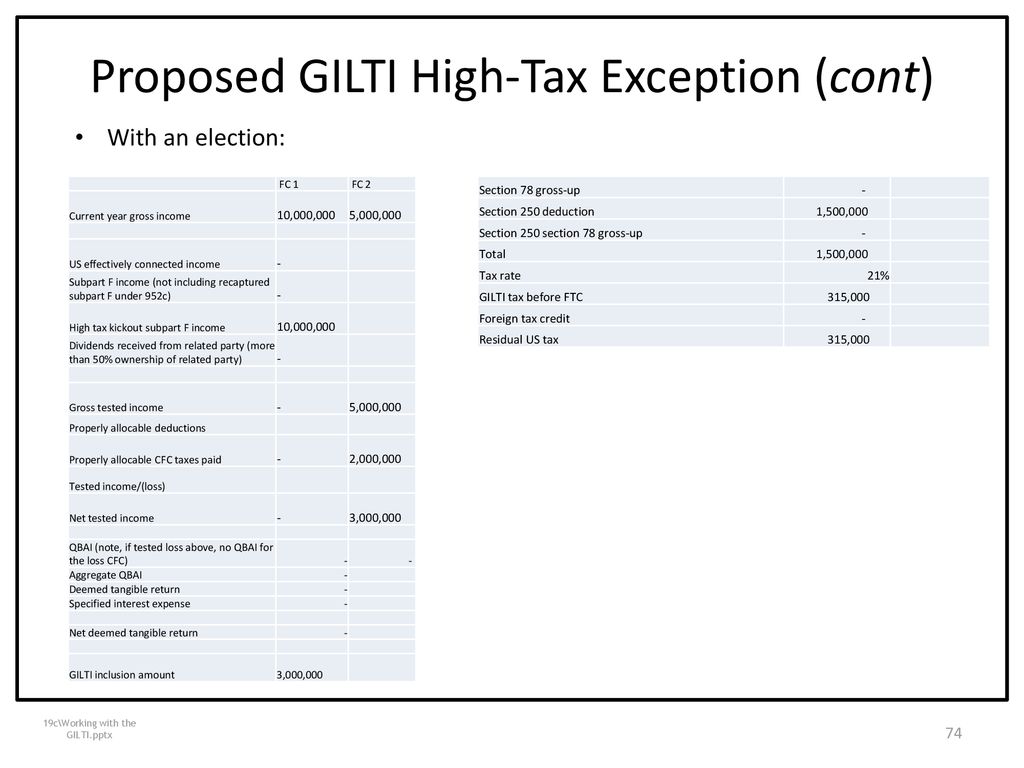

GILTI hightax exception together with the subpart F high- tax exception have the potential to broadly - expand a CFCs exempt income where it operates in sufficiently high. For example a noncorporate us shareholder that made a section 962 election or that contributed the shares of cfcs to a domestic c corporation could use the gilti high-tax. US Holdco a United States C Corporation is a holding corporation whose only source of income in Year 1 is GILTI from its investment in CFC 1 of 1000000.

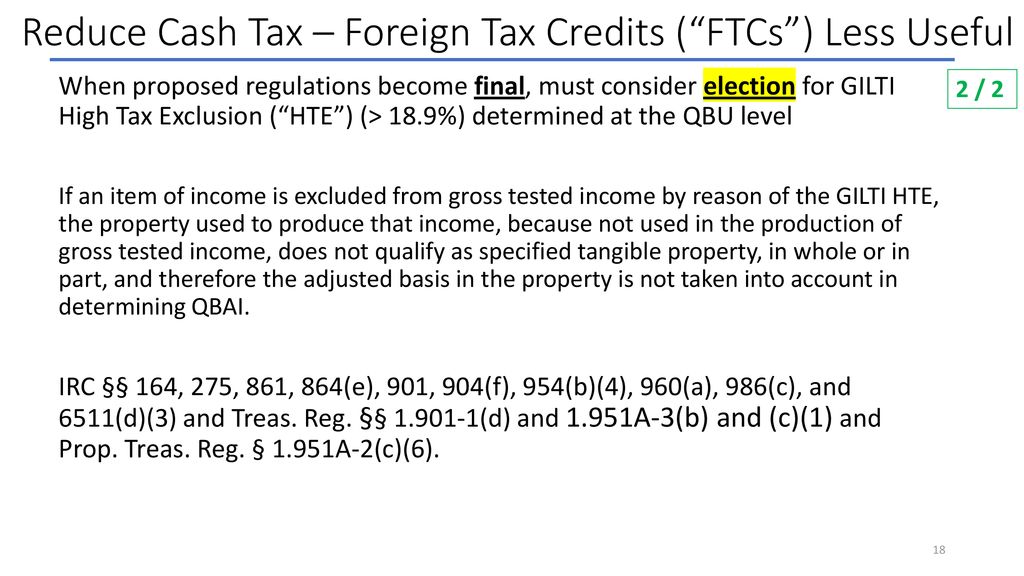

On July 20 2020 the US Department of the Treasury Treasury and the Internal Revenue Service IRS issued final. The 2019 Proposed Regulations and the 2020 Final Regulations set the threshold rate for claiming the GILTI high-tax election at 90. Election for tax years in which the US.

Elective GILTI Exclusion for High-Taxed GILTI. Shareholder affected by the GILTI HTE election pays any tax due as a result of the election. Gilti Detailed Calculation Example.

GILTI is a category of foreign income added to taxable income each year. The new tested unit. The IRS released final regulations on July 20 that expand the utility of the global intangible low-taxed income GILTI high-tax exclusion HTE and concurrently issued.

If the cfc is operating in more than one taxing jurisdiction or owns other entities the income of the cfc may need to be. The Required GILTI High-Tax Election Threshold Rate. 954b4 regardless if the income would.

CFC1 generates tested income subject to an effective local income tax rate of 15 and CFC2 generates tested income subject to a 25. Corporation owns 100 of two CFCs. Gilti high tax exception example.

In general 962 allows an. The high-tax exclusion applies only if the GILTI was subject to foreign income tax at an effective rate greater than 189 90 of the highest US. Assume CFC 1 has an.

With the introduction of the GILTI high-tax exception regulations taxpayers now have another strategy available that can be even more beneficial. Corporate tax rate which is 21. Key Considerations of GILTI High Tax Exclusion Final Regulations.

ABC Company is a US Corporation that owns 100 of two manufacturing plants located in a foreign. The final regulations addressing the new GILTI high-tax exception were issued on July 20 2020 and are effective as of September 21 2020. These final regulations allow.

New Regs Address High Taxed Income Exceptions When Foreign Tax Reduced

The High Tax Exception To Gilti Under The New Regulations Youtube

Tax News Gilti And Crazy Roundup February 5

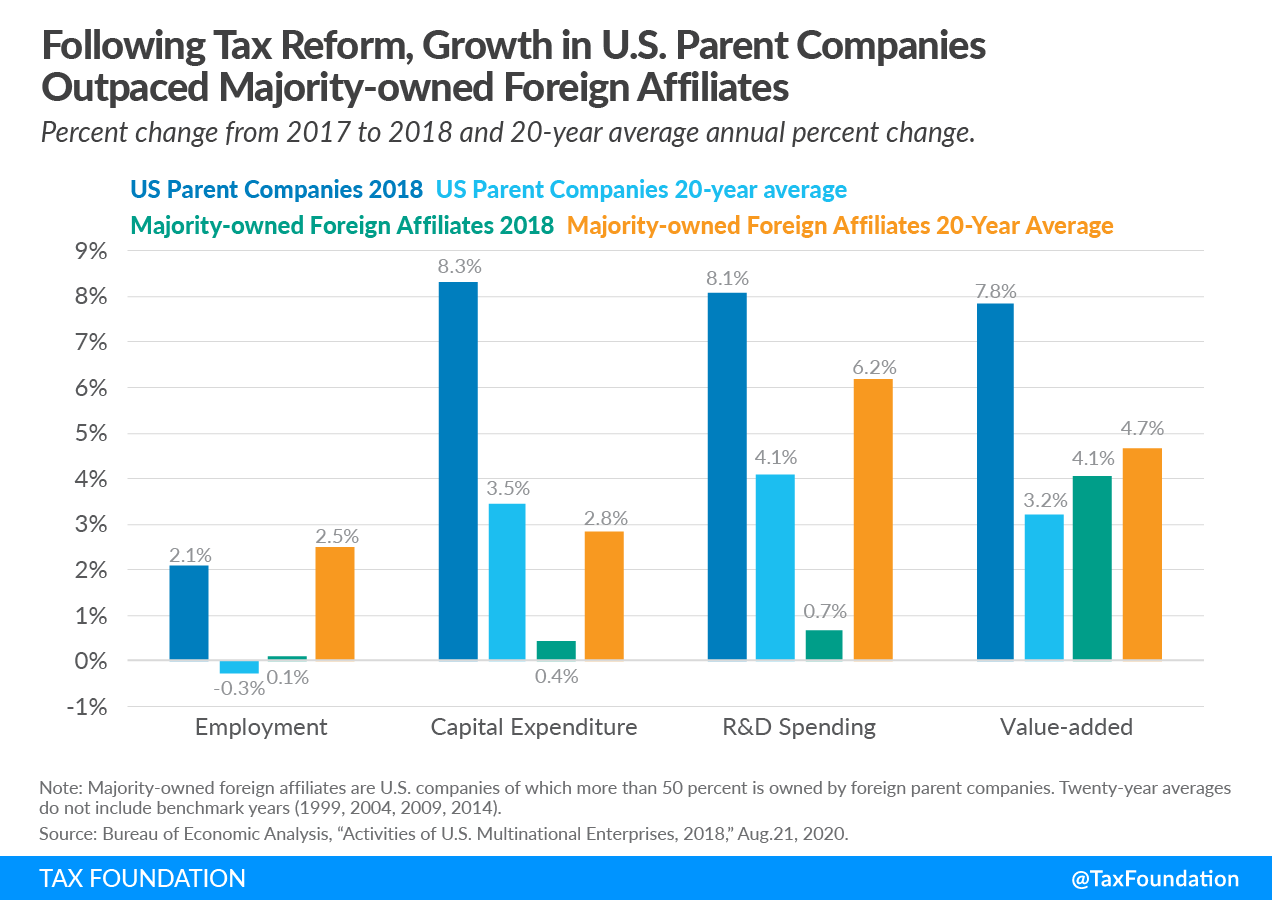

U S Cross Border Tax Reform And The Cautionary Tale Of Gilti

Tax News Gilti And Crazy Roundup February 5

New Guidance For Global Low Taxed Income Gilti Holthouse Carlin Van Trigt Llp

Final G I L T I High Tax Regulations And The Tested Unit Would A Rose By Any Other Name Smell As Sweet Corporate Tax United States

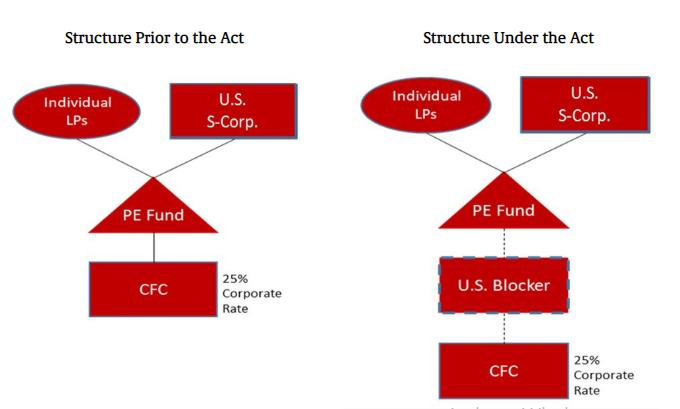

U S Cross Border Tax Reform And The Cautionary Tale Of Gilti

Gilti Regime Guidance Answers Many Questions

International Aspects Of Tax Cuts And Jobs Act 2017 Ppt Download

High Tax Exception To Global Intangible Low Taxed Income 2020 Articles Resources Cla Cliftonlarsonallen

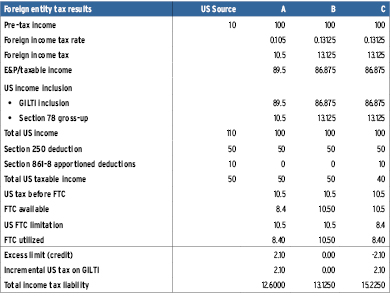

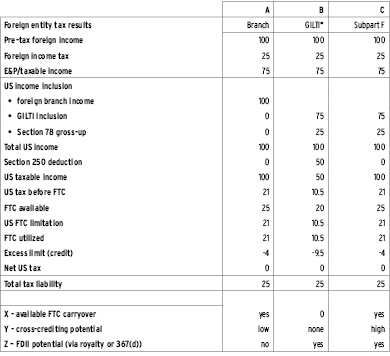

Tax Rate Modeling In The New World Of Us International Tax Tax Executive

Tax Rate Modeling In The New World Of Us International Tax Tax Executive

Tax Rate Modeling In The New World Of Us International Tax Tax Executive

Instructions For Form 5471 01 2022 Internal Revenue Service

Harvard Yale Princeton Club Ppt Download

Irs Releases First Round Of Proposed Gilti Regulations Alvarez Marsal Management Consulting Professional Services

Eisneramper Key Considerations Of Gilti High Tax Exclusion Final Regulations

New Proposed Regulations Would Ease Gilti Tax Burden On Non Corporate Taxpayers Lexology